From January 2026, older Australians relying on retirement income are set to receive higher super-related payments as part of scheduled adjustments to the Age Pension and related support schemes. While superannuation itself does not operate like a direct government payment, changes in pension rates, contribution timing, and support structures mean many retirees will see more in their retirement income packages this year.

The changes reflect key policy shifts designed to help seniors manage ongoing cost-of-living pressures, longer life expectancies, and evolving retirement planning norms. In this article, we break down exact figures, who benefits most, and what these changes mean for your retirement finances in practical terms.

What the Super Payment Increase Means in 2026?

In Australia, superannuation is a long-term retirement savings system funded mostly through employer Super Guarantee contributions and private contributions. It is not a government-paid income like the Age Pension.

However, the Age Pension which many retirees use in combination with super savings has increased, and changes to how super contributions are paid mean retirees can expect greater total retirement income over time.

Key Points in 2026

- Age Pension rates increased, benefiting retirees drawing from or alongside super.

- Super Guarantee timing changed to “payday super,” meaning faster contributions throughout the year.

- Super contributions on government paid parental leave begin mid-2026 for eligible adults, strengthening long-term balances.

The combination of these changes equates to higher overall retirement income potential for many seniors in 2026.

Exact Figures for Age Pension After 2026 Adjustments

The following table shows the weekly and annual amounts after the 2026 indexation, based on typical full-rate pension figures:

Age Pension Rates From January 2026

| Pensioner Type | Fortnightly Payment | Approximate Annual Total |

|---|---|---|

| Single pensioner (full) | $1,178.70 | ~$30,646 |

| Each member of a couple (full) | $888.50 | ~$23,101 |

| Couple combined (full) | $1,777.00 | ~$46,202 |

These figures combine the base pension and standard supplements. They do not include Rent Assistance or other add-ons which may apply.

Why These Figures Matter?

The link between super and Age Pension is central to retirement planning in Australia:

- Many retirees supplement their super income with Centrelink Age Pension.

- Higher pension rates mean more secure retirement income for those whose super alone is insufficient.

- Delayed super payment timing boosts compound growth.

Together, this increases the total retirement income stream for seniors in 2026 and beyond.

How the Super Guarantee Change Helps Future Retirees?

From 1 July 2026, employers are required to pay Super Guarantee contributions on payday, rather than quarterly. While this does not immediately affect retirees today, it benefits:

- Workers nearing retirement, as contributions earn returns sooner.

- People with irregular work histories, as contributions arrive more quickly.

- Future retirees, who compound growth more effectively.

“Payday super reduces the lag in contributions entering super funds,” said a retirement income specialist.

“Over long periods, even small timing advantages can add meaningful amounts to retirement balances.”

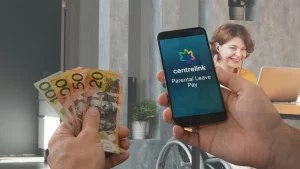

Super Contributions on Government Paid Parental Leave

Another important change in 2026 is the introduction of super contributions on government paid parental leave (PPL) for eligible parents.

This helps:

- Women who take extended leave build super balances.

- Reduce retirement income gaps linked to caregiving periods.

- Increase total lifetime super accumulated before pension age.

While this change kicks in mid-2026 and does not immediately boost pension payments, it strengthens future retirement financial security.

Who Benefits Most From the 2026 Changes?

The following groups stand to benefit significantly from the combined super and pension changes:

Full Pension Recipients

These retirees receive the largest direct impact through increased Age Pension rates.

Couples With Combined Super Savings

Higher combined pension and super drawdowns improve retirement stability.

Near-Retirement Workers

Payday super boosts accumulation in the final working years.

Parents Returning to Work

Super on PPL supports longer-term savings growth.

What These Changes Do Not Do?

Despite headlines suggesting big “super payments,” several things remain unchanged:

- The government does not issue lump-sum super payouts to retirees.

- Super balance itself does not increase automatically without contributions.

- Age Pension eligibility rules and means tests still apply.

- The Super Guarantee rate remains at 12% in 2026.

These structural details clarify that the improvements are income support enhancements, not direct “super cheque” payments.

Real-World Impact: Example Scenarios

Scenario 1: Single Pensioner on Full Rate

A retiree receives $1,178.70 per fortnight in 2026, compared with lower rates in prior years. Over 12 months, this change translates into a higher retirement income that helps cover essentials like utilities, groceries, or medications.

Scenario 2: Married Couple Combining Income

A couple both on full pension receive a combined $1,777.00 per fortnight. Enhanced pension rates help maintain shared expenses and reduce pressure on super drawdowns.

Scenario 3: Future Retiree Benefiting From Payday Super

A 60-year-old still working benefits from contributions hitting their super fund earlier each pay cycle, increasing compound earnings over their final working years.

Hard Truths About Super and Pensions in 2026?

Despite positive changes, several challenges remain:

- Super alone may not fund retirement for many Australians.

- The Age Pension is means tested, so higher super balances can reduce pension entitlements.

- Cost of living especially rent still strains fixed incomes.

“The pension increase helps, but broader retirement adequacy issues persist,”

said a retirement policy researcher.

Final Thoughts

The 2026 super-related changes, including higher Age Pension rates and improved contribution timing, help strengthen retirement income for many Australians. While the headline numbers such as $1,178.70 fortnightly for singles or $1,777.00 for couples are not direct government “super checks,” they reflect real improvements in total retirement income streams.

For retirees and those planning retirement, the 2026 adjustments offer a more secure foundation for managing living costs and navigating long-term retirement finances. Understanding how super and pension systems interact is essential to making the most of these changes.

FAQs

No. There is no new lump-sum super payment. Increases are reflected in Age Pension and structural super changes.

Age Pension payments are generally non-taxable, but super income streams may have tax implications.

No. Rent Assistance eligibility is assessed separately.

Yes. Eligible pensioners receive the increases without reapplication.

Higher super balances can affect means-tested pension amounts.

Leave a Comment