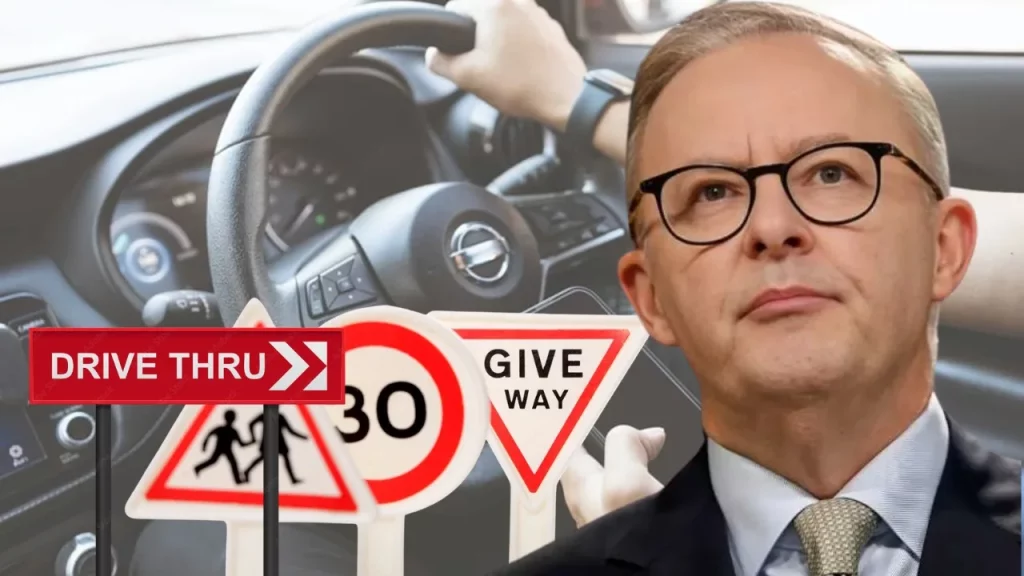

For decades, cash formed the backbone of everyday transactions in Australia. From paying for groceries at suburban supermarkets to buying coffee at local cafés, physical money symbolized convenience, privacy, and certainty. But that relationship is changing at remarkable speed. Across cities and regional towns alike, Australians are increasingly tapping cards, scanning phones, and transferring money digitally, leaving notes and coins behind.

Australia is now among the world’s fastest-moving digital payments economies. What once felt optional has become routine. In many places, cash is no longer the first choice but an afterthought. This shift has sparked a national debate that goes far beyond technology. It raises questions about inclusion, consumer rights, privacy, and whether Australians should retain the freedom to choose how they pay.

As banks, businesses, and policymakers adapt to this reality, the future of cash has become a defining economic and social issue.

Australia’s Rapid Shift Toward Digital Payments

The speed of Australia’s transition away from cash is striking. According to long-term data from the Reserve Bank of Australia, cash once dominated consumer payments. In the mid-2000s, it accounted for the majority of in-person transactions. Today, it represents a small and shrinking share.

Contactless “tap-and-go” payments, introduced early and widely in Australia, laid the foundation for this change. Debit and credit cards quickly became more convenient than cash, particularly for small-value purchases. Mobile wallets such as Apple Pay and Google Pay further accelerated the trend, turning smartphones into everyday payment tools.

A senior official familiar with national payment trends explained the shift clearly:

“Australians did not abandon cash overnight. The change happened because digital payments became easier, faster, and more reliable than physical money.”

The COVID-19 pandemic intensified this movement. Health concerns, social distancing, and lockdowns pushed consumers and businesses toward contactless options. What began as a precaution soon became habit.

How Cash Usage Has Declined Over Time?

The decline of cash is not anecdotal; it is measurable. The central bank has tracked payment behavior for years, revealing a steady and consistent drop.

Decline in Cash Usage in Australia (Approximate Share of Consumer Payments)

| Year | Cash Usage Share |

|---|---|

| 2007 | ~70% |

| 2013 | ~47% |

| 2019 | ~27% |

| 2022 | ~13–15% |

| 2025 (est.) | Below 10% |

This decline reflects not just consumer preference but also structural change. As fewer people use cash, maintaining cash infrastructure becomes more expensive, reinforcing the cycle.

Government and Regulatory Signals on Cash

Despite the clear downward trend, Australia has not formally abolished cash. Banknotes and coins remain legal tender, and there is no federal law mandating a cashless economy. However, regulatory signals suggest policymakers are preparing for a future where cash plays a much smaller role.

The Australian Treasury has acknowledged the rapid decline in cash use while emphasizing the importance of access during the transition. Reviews and consultations have focused on protecting vulnerable groups, particularly older Australians, people with disabilities, and residents in remote communities.

A Treasury representative summarized the approach:

“Digital payments are now central to economic activity, but cash still plays a role in inclusion and resilience. Managing the transition responsibly is essential.”

At the same time, banks are under pressure. Cash handling involves transport, security, insurance, and staffing costs. As usage falls, many institutions have reduced branch-based cash services, prompting concern among customers who still rely on physical money.

Businesses Drive the Move Toward Cashless Models

In practice, businesses are often moving faster than regulators. Across retail, hospitality, and entertainment sectors, cashless operations are becoming common.

For small businesses, handling cash can be costly and risky. Digital payments reduce theft, counting errors, and administrative workload. Automated records also simplify accounting and tax reporting.

A small business owner in Melbourne explained the decision:

“Going cashless reduced stress for staff and cut down on end-of-day errors. Most customers already preferred card payments.”

Large venues and events have also embraced cashless systems. Stadiums, festivals, and public transport networks increasingly rely on digital ticketing and contactless payments, reinforcing cashless habits in everyday life.

Advantages of a Cashless Economy

Supporters argue that the decline of cash brings tangible benefits for consumers, businesses, and governments.

Key advantages often cited include:

- Faster transactions and shorter queues

- Lower operating costs for businesses

- Reduced risk of theft and counterfeit currency

- Improved transparency and reduced tax evasion

- Better integration with online commerce

Australia’s fintech sector has benefited as well. New payment platforms, instant transfers, and budgeting tools depend entirely on digital infrastructure.

A payments industry analyst noted:

“Digital payments reduce friction across the economy. They support innovation and make commerce more efficient.”

From this perspective, cash is not being taken away but naturally replaced by superior alternatives.

Concerns Over Exclusion, Privacy, and Choice

Despite the efficiency gains, critics warn that a fully cashless economy carries risks. Advocacy groups stress that not all Australians can easily access or trust digital systems.

Elderly citizens may struggle with apps and online banking. Low-income individuals may lack smartphones or stable internet access. Regional and remote communities often face connectivity challenges, making digital-only payments unreliable.

A community advocate raised concerns bluntly:

“Cash is a safety net. When systems fail or people are excluded, cash still works.”

Privacy is another major issue. Digital payments generate data trails that can be stored, analyzed, and potentially misused. While most transactions are lawful, critics worry about increased surveillance and reduced anonymity.

Australia in a Global Context

Australia’s experience mirrors trends in other advanced economies, but its pace stands out. Some countries have moved cautiously, while others have embraced cashless systems more aggressively.

International Approaches to Cash and Digital Payments

| Country | Cash Usage Trend | Policy Approach |

|---|---|---|

| Australia | Rapid decline | Market-led transition |

| Sweden | Very low | Strong cashless push |

| Germany | Moderate | Cash culturally protected |

| Japan | Moderate | Cash still widely used |

| United States | Gradual decline | Mixed state-level rules |

International institutions such as the Bank for International Settlements have urged governments to preserve cash access during transitions, citing resilience and trust.

Australia’s approach has largely relied on consumer choice rather than mandates, but the long-term outcome remains uncertain.

The Future Role of Cash in Australia

Most experts agree that cash will not disappear overnight. Instead, it is likely to become a niche payment method.

Possible future roles for cash include:

- Backup during system outages or cyber incidents

- Continued use in remote and regional areas

- Preference-based use for privacy-conscious consumers

- Emergency situations where digital systems fail

The Reserve Bank of Australia has repeatedly stated it will continue issuing banknotes as long as there is public demand. However, the scale of cash circulation is expected to keep shrinking.

Some policymakers have proposed minimum cash acceptance rules for essential services. Others argue that forcing businesses to accept cash would impose unnecessary costs and slow innovation.

Digital Currency and the Next Phase of Payments

Adding another layer to the debate is the exploration of a central bank digital currency, or CBDC. The Reserve Bank of Australia has conducted pilot projects examining how a digital Australian dollar might function.

A CBDC would not immediately replace cash, but it could further reshape the payments landscape. Supporters argue it could combine digital convenience with central bank backing. Critics worry it could accelerate the decline of cash and raise new privacy concerns.

An economist involved in the pilot process explained:

“CBDC research is about preparedness and options. It does not mean cash is being switched off.”

Why the Cashless Debate Matters?

The debate over cash is ultimately about more than payments. It reflects broader questions about inclusion, autonomy, and trust in institutions. For some Australians, going cashless represents progress and efficiency. For others, it feels like a loss of control and choice.

As digital payments become dominant, the key issue is not whether cash use will decline, but how the transition will be managed. Decisions made today will shape financial access, privacy, and resilience for decades.

FAQs

Yes, cash remains legal tender and can still be used.

Yes, unless a law or contract requires cash acceptance.

Consumer preference, technology, and efficiency drive the shift.

Experts say it will decline further but not vanish soon.

No formal ban exists, but digital payments are being encouraged.

Leave a Comment